Galliard Stable Return Fund

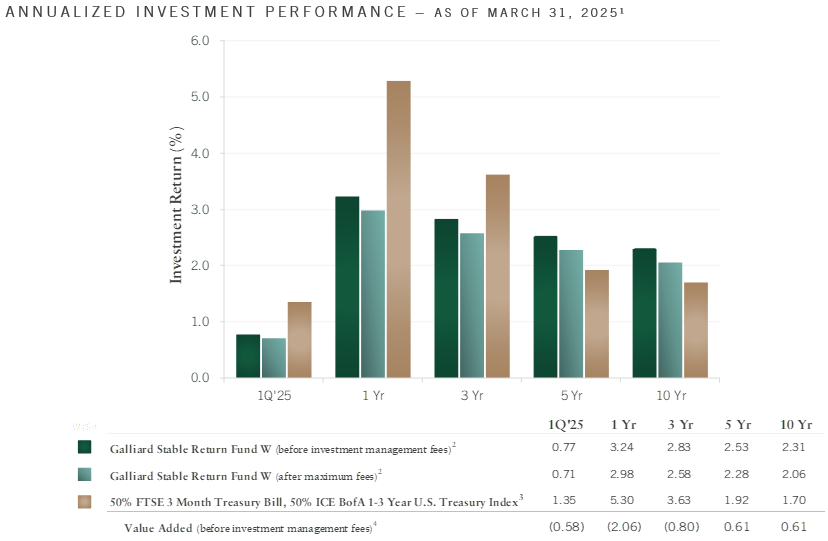

ANNUALIZED INVESTMENT PERFORMANCE - AS OF DECEMBER 31, 2025¹

Past performance is not an indication of how an investment will perform in the future. The principal value and investment return of the funds will fluctuate so that you may have a gain or loss when you sell your units.

1: Returns for periods less than one year are not annualized. 2: Returns designated as “before fees” include all income, realized and unrealized capital gains and losses and all annual fund operating expenses. Returns designated as “after maximum fees” are the “before fees” amounts less the maximum 0.25% fee which may be charged by Galliard for management of each client’s account. Returns may have been impacted by the effect of compounding and have been rounded to the nearest basis point. Fees which may be charged to each client for investment management are described in Galliard Capital Management’s Form ADV Part 2 which is available upon request. 3: Benchmark returns do not include potential transaction costs or management fees. © 2026 Ice Data Indices, LLC. All rights reserved. For comparison purposes the benchmark is fully invested and includes the reinvestment of income. While it is believed that the benchmark used here represents an appropriate point of comparison for the Fund referenced above, prospective investors should be aware that the volatility of the above referenced benchmark or index may be substantially different from that of the Fund; and holdings in the Fund may differ significantly from the benchmark or index if the investment guidelines and criteria are different than the Fund. 4: May not add due to rounding.

For more information, please refer to the GIPS composite report found under Disclosure in the Reporting Resources tab.

The Fund’s investment contracts are designed to allow for participant transactions at book value. A principal risk of the Fund is investment contract risk. This includes the risk that the issuer will default on its obligation under the contract or that another event of default may occur under the contract rendering it invalid; that the contract will lapse before a replacement contract with favorable terms can be secured; or that the occurrence of certain other events including employer-initiated events, could cause the contract to lose its book value withdrawal features. These risks may result in a loss in value to a contract holder. Other primary risks include default risk, which is the possibility that instruments the Fund holds will not meet scheduled interest and/or principal payments; interest rate risk, which includes the risk of reinvesting cash flows at lower interest rates; and liquidity risk, which includes the effect of very large unexpected withdrawals on the Fund’s total value. The occurrence of any of these events could cause the Fund to lose value.

The information on Galliard’s website is for institutional use only and may be used only by Galliard’s institutional clients and retirement plan sponsors, as well as their consultants, and advisors. Performance information is not intended for use by the general public or to provide investment advice or recommendations, nor are they an offer or solicitation to the general public to buy or sell any investment products.

SEI Trust Company (the “Trustee”) serves as the Trustee of the Fund and maintains ultimate fiduciary authority over the management of, and the investments made, in the Fund. The Fund is part of a Collective Investment Trust (the “Trust”) operated by the Trustee. The Trustee is a trust company organized under the laws of the Commonwealth of Pennsylvania and wholly owned subsidiary of SEI Investments Company (SEI). The Trust is not a mutual fund, as defined under the investment company act of 1940, as amended.

A collective investment trust fund (CIT) is a pooled investment vehicle that is exempt from SEC registration as an investment company under Section 3(c)(11) of the Investment Company Act of 1940 and maintained by a bank or trust company for the collective investment of qualified retirement plans. The Fund is managed by SEI Trust Company, the trustee, based on the investment advice of Galliard Capital Management. Galliard receives no management fee for its role as Investment Advisor.